Understanding Health Insurance in India: Your Key to Financial Security and Better Healthcare

Health insurance in India isn’t just for emergencies anymore—it’s an essential safety net for anyone who wants to avoid the financial strain that can come with medical expenses. As healthcare costs rise, having insurance means you’re not forced to empty your savings due to an unexpected illness or accident. Let’s explore why health insurance is so important, and how you can choose the right plan for you and your family.

Why Do You Need Health Insurance?

Picture this: you or a family member falls sick, and suddenly, you’re looking at a huge hospital bill. Without insurance, paying for treatments, surgeries, and even regular doctor visits can quickly eat into your savings. This is where health insurance steps in—covering these costs and giving you one less thing to worry about during a stressful time.

In India, health insurance doesn’t just cover hospital bills. Many plans also offer pre-and post-hospitalization benefits, meaning tests, medicines, and follow-up consultations might also be included. In short, it’s a financial cushion that helps you focus on getting better without the added stress of massive expenses.

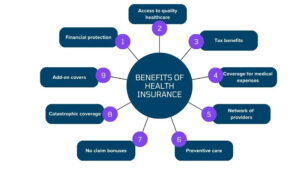

Benefits of Health Insurance

Health insurance is more than just a financial product—it’s a lifeline in times of medical need. One of its key benefits is the protection against high medical expenses. With healthcare costs on the rise, having insurance helps cover hospital bills, treatments, and surgeries, so you don’t have to empty your savings. Many plans even include pre- and post-hospitalization coverage, which means costs like diagnostic tests, medications, and follow-up visits are also taken care of. This allows you to focus on recovering without the burden of financial stress.

Another major benefit is the option for cashless hospitalization. If you’re admitted to a hospital in your insurer’s network, the bill is settled directly with the hospital, so you don’t have to worry about paying upfront. Health insurance also provides a sense of security, knowing that in case of emergencies, you’re financially prepared. Furthermore, most insurers offer free annual health check-ups, encouraging policyholders to stay on top of their health and detect potential issues early on.

Different Types of Health Insurance Plans

When it comes to choosing a health insurance plan, you have options that can suit different needs and stages of life. Here are the main types:

- Individual Health Insurance: This is for one person, covering only their medical expenses. It’s ideal if you’re young and healthy, or if you want a plan just for yourself.

- Family Floater Plan: Think of this as an umbrella plan that covers the whole family—spouse, kids, and sometimes even parents. The premium is typically lower compared to buying individual plans for each member.

- Critical Illness Insurance: This is specific to severe illnesses like cancer, heart disease, or kidney failure. These diseases often require expensive treatment, and critical illness insurance gives a lump sum payout to help with those costs.

- Senior Citizen Health Insurance: Designed for people over the age of 60, these plans offer coverage for health issues that are more common in older adults. They can also include things like home treatment or coverage for pre-existing conditions.

- Group Health Insurance: Often provided by companies to their employees, group insurance can offer basic health coverage. It’s a great benefit, but ensure it’s enough for your personal and family needs. You might need additional coverage.

What Should You Look for in a Health Insurance Plan?

Choosing the right health insurance can feel overwhelming, but keeping these things in mind can help:

- Hospital Network: Most insurers have tie-ups with hospitals where you can get cashless treatment. This means the insurer settles the bill directly with the hospital, and you don’t have to pay upfront. Ensure the insurance provider has hospitals near you in their network.

- Comprehensive Coverage: Beyond just hospitalization, check whether the policy covers other costs like diagnostic tests, medicines, and post-treatment follow-ups. Many plans also cover daycare treatments that don’t require you to stay overnight, like cataract surgery or chemotherapy.

- Waiting Period for Pre-Existing Conditions: If you already have a medical condition, you’ll likely have a waiting period before it’s covered. This can be anywhere between 2 to 4 years, so read this part carefully before committing to a plan.

- No-Claim Bonus: If you don’t make any claims during the year, many insurers reward you by increasing your sum insured without upping the premium. This is a nice bonus if you’ve had a healthy year.

- Claim Settlement Ratio: The claim settlement ratio tells how likely an insurance company is to settle claims. A higher ratio means they’re more reliable in handling claims quickly and fairly.

The Government’s Role in Health Insurance

For those who can’t afford private insurance, the Indian government has launched several initiatives to provide healthcare coverage to lower-income families. Ayushman Bharat, for instance, covers over 50 crore individuals, offering them free hospitalization for major treatments up to ₹5 lakh per family annually. Programs like this make sure even the underprivileged have access to healthcare.

Conclusion

Health insurance in India is no longer a luxury—it’s a necessity. Whether you’re single, have a family, or are nearing retirement, there’s a plan out there for you. With the right coverage, you can protect yourself from unexpected medical expenses and focus on what truly matters: your health and the well-being of your loved ones.

Read This Also: ICICI Prudential Life Insurance: A Comprehensive Guide